Space Tugs as a Service: In-orbit service providers are bracing for consolidation

By Jason Rainbow

Orbital transfer and servicing providers are bracing for a space tug of war as they jostle for position in an increasingly crowded market.

Newcomers are flooding into a space tug industry that has only emerged in recent years, pushing their own ideas to give operators greater flexibility for deploying and maintaining satellites.

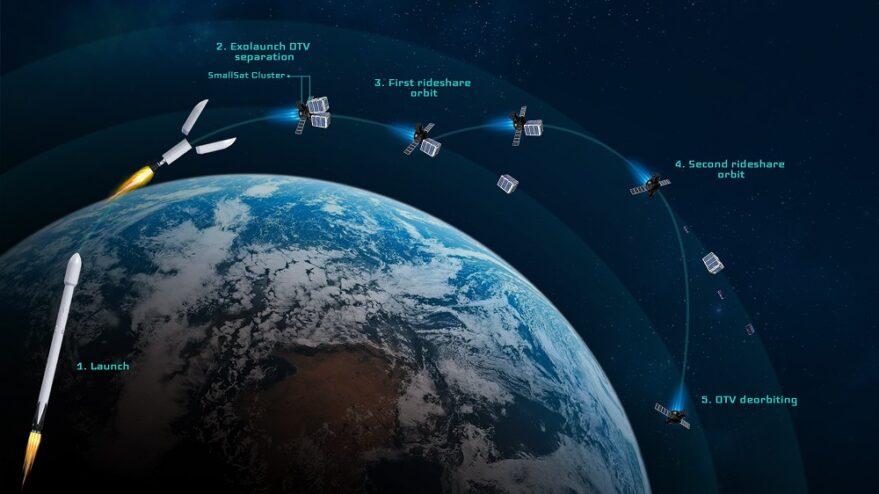

At one end of the spectrum, companies such as Spaceflight, Exolaunch and Momentus are devising tugs that satellites attach to on the ground before they are transported to custom orbits post-launch. These services enable customers to cut costs by reducing a satellite’s onboard propulsion, or by removing it altogether and hosting the payload on the tug — sometimes called an orbital transfer vehicle (OTV).

At the other end, Northrop Grumman and Astroscale are among those offering tugs that dock with already launched satellites to change orbits, enlarge fuel reserves or give them the ability to deorbit safely.

Just a handful of space tug ventures have managed to provide commercial services. On the post-launch servicing side, only U.S. aerospace defense giant Northrop Grumman has provided services to an in-orbit customer to date.

Even still, consolidation is widely expected to already be in the cards for the fast-evolving market.

A MARKET OF FIRSTS

Italy’s D-Orbit completed what it said was the world’s first commercial last-mile delivery service Oct. 28, after its In-Orbit Now (ION) vehicle dropped off 12 satellites for Planet over two months.

While regulatory delays have entangled plans by Silicon Valley startup Momentus to offer similar services, Seattle-based Spaceflight deployed 15 spacecraft from the debut flight of its Sherpa-FX space tug in January.

Spaceflight, which brokers rideshare launch services for satellite operators, plans to launch another Sherpa-FX on the SpaceX Transporter-2 mission scheduled at the end of June.

That mission will also include its new, electric propulsion-powered OTV Sherpa-LTE.

Spaceflight expects to fly another next-generation OTV called Sherpa-LTC, which will use chemical propulsion, on a separate SpaceX mission later this year.

“Space tugs have the potential to fundamentally change the smallsat market,” Spaceflight vice president of engineering Phil Bracken said.

“With on-orbit propulsive capabilities, orbits that were once out of reach, due to cost or propulsion capabilities, will be viable options which addresses a growing market need for orbit diversification.”

Until recently, most small satellite customers were just trying to prove their technology, choosing bulk deployments on large rockets when most orbits were desirable for this.

However, as the small satellite market matures, they are increasingly looking for specific orbits for optimal, revenue-generating services.

Sometimes their technology calls for “extreme final orbit states” that rideshare services or even dedicated small launch vehicles cannot reach, added Bracken.

He said early tug missions will focus on inclination changes, or smaller altitude adjustments, but a wider range of services will emerge as more OTVs prove capabilities. These include on-orbit transportation from low Earth orbit (LEO) to medium, geostationary, lunar orbits and beyond.

This growing market opportunity recently prompted Germany’s Exolaunch, which also brokers rideshare missions, to announce plans to conduct flight tests for its own space tugs next year.

Like Sherpa, Exolaunch’s Reliant tugs will first combine with satellites on the ground before sending them to custom orbits post-launch.

In 2023, the company aims to flight test a Reliant Pro configuration capable of making additional adjustments, including the inclination of a satellite’s orbit.

In the future, Exolaunch hopes its tugs will be able to dispose of space junk before they deorbit after completing their primary mission.

These plans come as the commercial small satellite market matures and proves to not be just a series of one-off launches, according to Exolaunch chief operating officer Alexander Kabanovsky.

“Putting satellites into orbit has become predictable, reliable and more affordable,” Kabanovsky said.

“As a result, the number of satellites slated to go up into space is growing exponentially and individual orbits have become more desirable. With that immense growth also comes the question of management of space debris, responsible use of space and de-orbiting end-of-life satellites to the fore.”

D-Orbit has also outlined plans to tackle debris one day with its OTVs, which currently also offer hosted payload services after finishing their satellite deployments, putting the Italian company and Exolaunch in the middle of a space tug market offering cradle-to-grave services.

NEW LIFELINES

The satellite-servicing and debris-removal sectors are less developed than the segment of the market aimed at helping small satellites and other secondary payloads reach their final destinations.

However, landmark in-orbit servicing achievements by Northrop Grumman in GEO, and an upcoming demo mission this year in LEO from Astroscale, are propelling the market forward.

Northrop Grumman’s Mission Extension Vehicle-2 (MEV-2) successfully attached to Intelsat’s 10-02 spacecraft April 12 to extend its life, marking the first time a servicer has docked with an in-service commercial satellite in GEO.

A year earlier, its predecessor MEV-1 attached to Intelsat’s IS-901 satellite, lifting the sidelined spacecraft out of GEO graveyard orbit and back into service.

The success of these two missions is showing the industry that in-orbit servicing is now a reality, according to Joe Anderson, vice president of Northrop Grumman’s SpaceLogistics subsidiary.

“We see the future for in-orbit servicing and the possibilities it brings growing exponentially over the next few years,” Anderson said.

MEV-1 and MEV-2 will remain docked for five years before moving to a customer it has yet to book.

In the meantime, the company plans to launch more in-orbit servicing products in 2024 that will work in tandem with each other: a Mission Robotic Vehicle (MRV) and Mission Extension Pods (MEPs).

The MRV aims to carry out more advanced in-orbit servicing tasks such as installing an MEP, a smaller life extension service that is less expensive than an MEV.

“These products will introduce additional capabilities to the market including on-orbit repair, augmentation, assembly and detailed inspection while still offering life extension services,” Anderson said.

“Our vision is that satellites launched after 2025 will include servicing interfaces that will enable them to be serviceable, maintainable and upgradeable.”

Tokyo-based Astroscale also expects servicing interfaces will be fitted to future satellites that make it easier for tugs to carry out missions.

The venture was close to performing its first end-to-end test of key technologies for in-orbit debris removal in early June, with an ELSA-d servicer spacecraft launched to LEO in March.

“With a paradigm shift underway, moving from the traditional launch-it-and-leave-it approach to space to one where we’re building in-space logistics and infrastructure, you’re seeing innovative companies moving into this market to take advantage of new demand signals,” Dave Fischer, Astroscale’s vice president of business development and advanced systems, said.

SPACE TUGS AS A SERVICE

The growing momentum behind space tugs is encouraging others to get hitched to the market.

Two former Blue Origin and NASA engineers founded Kent, Washington-based Starfish Space in late 2019 to launch an all-electric tug called Otter as early as 2023.

Co-founder Trevor Bennett said Otter saves costs by being smaller than others under development, which will enable Starfish to operate a network of them in space for “on-demand” satellite servicing. “Our two core missions will be satellite-life-extension-as-a-service and space-debris-removal-as-a-service,” Bennett said.

“For life extension this is effectively a subscription model, while for debris removal it looks more like requesting an Uber or Lyft ride.”

Starfish and Astroscale are developing servicing businesses for multiple orbits.

Astroscale is exploring business models where value for customers can meet sustainability targets for the space environment.

“That could mean multiyear contracts for extending the life of a single satellite in GEO, or it could mean management services across an entire fleet of satellites in multiple orbits,” Fischer said.

“For government customers, we envision both service models, as well as more traditional sales of spacecraft for government operation.”

Anderson of SpaceLogistics said its Mission Extension Pods will include the price of being installed by one of its Mission Robotic Vehicles.

These two products are based on the Mission Extension Vehicles currently in orbit, however, unlike them the MRV will have two dexterous robotic arms.

The MEP is much smaller at about the size of a minifridge, compared with the MEV and MRV that are around the size of a small SUV, and its structure is also simpler because it is only capable of performing orbit control.

“Other robotics services such as inspections and repairs are provided as a service fee based on [change in velocity] required, time and complexity of the mission,” Fischer continued.

TUG OF WAR

Some form of consolidation is widely expected to take place in the increasingly crowded space tug market.

Although SpaceLogistics has not yet booked follow-on customers for the two satellite servicers currently in operation, Anderson said it sees demand for more than 10 life extension missions a year in GEO.

SpaceLogistics expects to service up to five of these each year with the upcoming launch of its Mission Extension Pods and their robotic installers, leaving room for other providers.

However, Anderson pointed to how consolidation is historically a big part of the aerospace industry.

“With such a big influx of startup companies in such a new market area, we should not be surprised by consolidation; especially between companies with complementary capabilities,” he said.

And while Spaceflight’s Bracken said pre-life space tugs are a great offering to expand capabilities and final orbit opportunities for customers, which can reduce the need for onboard propulsion equipment, he noted these are only helpful some of the time.

A customer looking to send a relatively uncomplicated satellite to sun-synchronous orbit (SSO) at 500 kilometers, for instance, might find the lowest launch cost with a rideshare mission because that orbit is heavily serviced.

“More often than not, traditional missions will still suit most customers’ needs, deploying directly from the launch vehicle to the desired orbit,” Bracken said.

“Because of this, there isn’t likely room in the industry for dedicated space tug providers, thus consolidation can be expected.”

For Exolaunch’s Kabanovsky, the greatest challenge — and simultaneously the largest opportunity — is to continue to prove that space is economically sustainable.

“The additional challenge will be to find cost-effective solutions to large problems, space debris being only one of them,” Kabanovsky said.

“Keeping investment capital flowing into the industry despite the failures that the industry will inevitably face, will be another interesting issue to overcome.”

This article originally appeared in the June 2021 issue of SpaceNews magazine.

July 6, 2021 at 02:30PM

via SpaceNews read more...

Post a Comment